University of Notre Dame Accountancy Professor Peter Easton on Wednesday (Oct. 18) testified in Manhattan federal court in one of the largest fraud cases in the history of the United States — the trial of disgraced FTX founder Sam Bankman-Fried, now in its third week.

Bankman-Fried, who says he never intended to defraud customers, has pleaded not guilty to two counts of fraud and five counts of conspiracy. Prosecutors say he looted billions of dollars in FTX customer funds.

Easton, who previously worked on other high profile cases including Enron, WorldCom and Parmalaat, was hired by the U.S. Department of Justice to provide a detailed analysis of the exchange of billions of dollars between FTX and its sister hedge fund, Alameda Research. He examined whether balances in actual bank accounts matched those in FTX’s internal ledgers in an effort to explain what happened to $9 billion in FTX customer funds missing in June 2022, months before the company filed for bankruptcy.

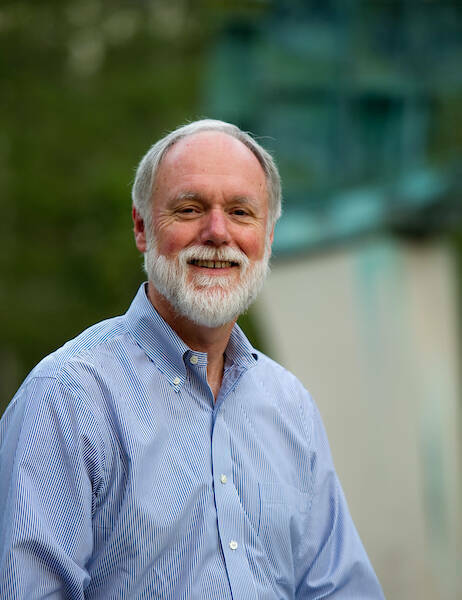

The director of the Center for Accounting Research and Education and the Notre Dame Alumni Professor of Accountancy at the Mendoza College of Business, Easton specializes in corporate valuation and financial statement analysis. He told the court, “I teach, essentially, penetrating financial statements.”

When asked if his analysis showed the use of customer funds, Easton said, “Oh yes.”

During his extensive testimony, Easton revealed the amount in Alameda Research and FTX’s accounts was far less than what was owed to customers of FTX. He found that $11.3 billion in FTX customer funds should have been held at Alameda, but only $2.3 billion were actually in its bank accounts and that Alameda used the assets for its own expenditures.

Easton said, “Customer funds were used in various ways,” including investments, political contributions, charity foundations and real estate purchases, backing prosecutors’ claims that Bankman-Fried funneled money from his FTX customers into Alameda for those purposes.

Using numerous charts and graphs he created, Easton showed that more than $400 million of customer funds were sent to hedge fund Modulo Capital. He said, “It is only customer funds. It did not come from anywhere else.”

He also traced $70 million of investor funds in real estate throughout the Bahamas, including Bankman-Fried’s luxury penthouse, and showed that millions of dollars in customer funds from FTX’s exchange was donated to a super PAC benefiting Democrats. He showed that a large sum of customer funds went to Modulo Capital through an investment made by Alameda and said FTX customers’ crypto assets were used to help repay a loan Alameda received from Genesis Capital.

The defense is set to begin presenting its case on Oct. 26 (Thursday). Bankman-Fried faces decades in prison if convicted.